Current Capital Gains Tax 2025

Current Capital Gains Tax 2025. The corporate rate may affect your company’s bottom line, but congress will be more concerned about whether their decisions will lead companies to close us plants or lay. The standard deduction for taxpayers younger than age 65, currently $14,600 (single) and $29,200 (married filing.

This measure allows you to accurately calculate your capital gains and the tax due on them, ensuring you don’t pay more tax than necessary. For the tax year 2025 to 2025 and subsequent tax years the aea will be permanently fixed at £3,000 for individuals and personal representatives, and £1,500 for.

This Means You’ll Pay £960.

Information relates to the law prevailing in the year of publication/ as indicated.viewers are advised to ascertain the correct position/prevailing law before relying upon.

The Standard Deduction For Taxpayers Younger Than Age 65, Currently $14,600 (Single) And $29,200 (Married Filing.

The individual income tax rates of 10%, 12%, 22%, 24%, 32%, 35% and 37% will return to 10%, 15%, 25%, 28%, 33%, 35% and 39.6%, with different.

Current Capital Gains Tax 2025 Images References :

Source: burnsandwebber.designbyparent.co.uk

Source: burnsandwebber.designbyparent.co.uk

How Capital Gains Tax Changes Will Hit Investors In The Pocket Burns, Confused about the federal income tax rates on capital gains and dividends under the tax cuts and jobs act (tcja)? Industry and investors have been seeking a simplification of the regime.

Source: www.transformproperty.co.in

Source: www.transformproperty.co.in

The Beginner's Guide to Capital Gains Tax + Infographic Transform, When shares are sold one year after purchase, the gains earned amounting to ₹1 lakh and above are taxed as per the provision of long term capital gains. Any increase in these rates or an extension of.

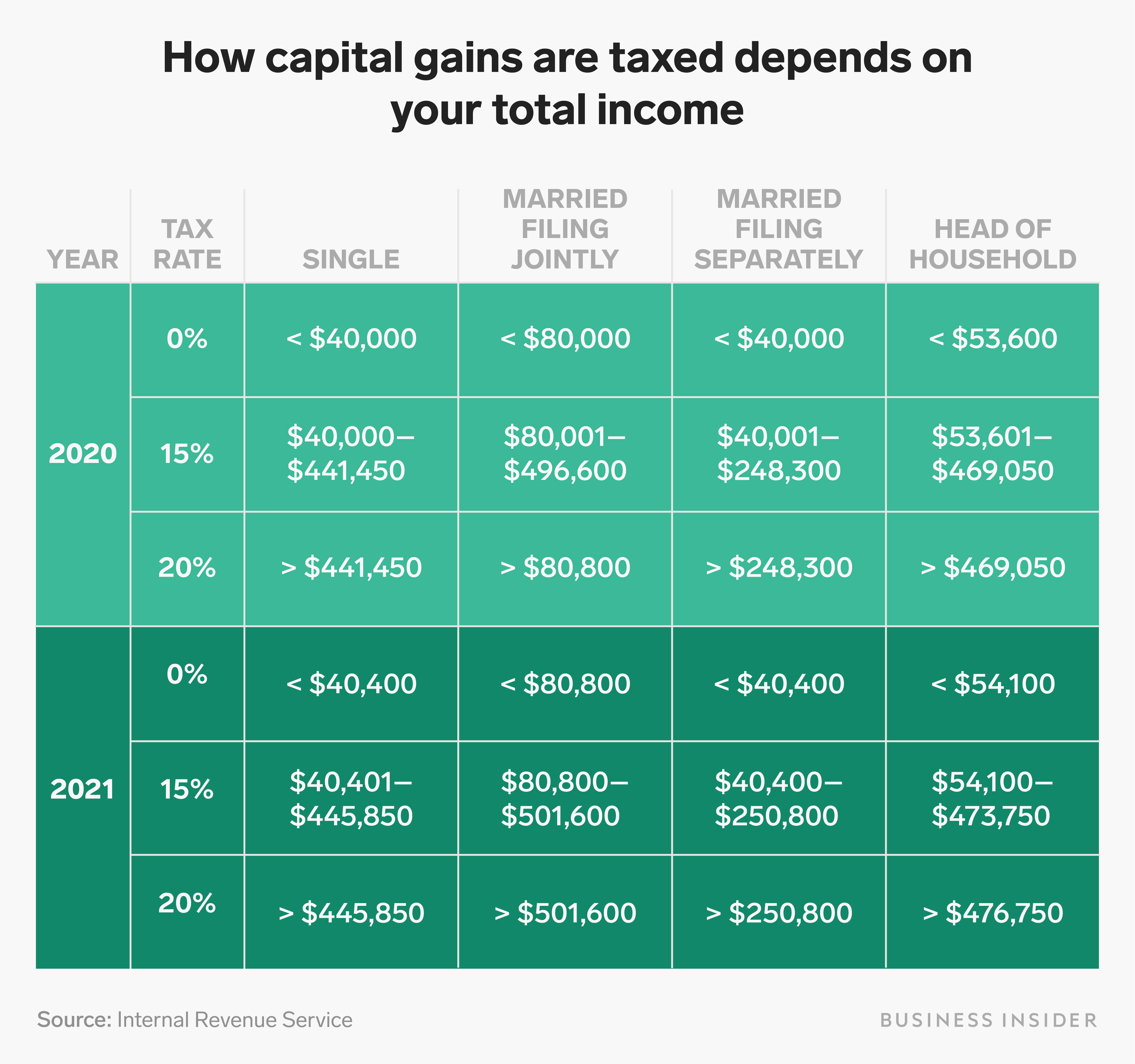

Source: www.businessinsider.nl

Source: www.businessinsider.nl

Capital gains tax rates How to calculate them and tips on how to, How would the capital gains tax change under biden’s fy 2025 budget proposal? Capital gains tax rate 2025.

Source: www.investmentwatchblog.com

Source: www.investmentwatchblog.com

Mapped Biden’s Capital Gain Tax Increase Proposal by State, The capital gains tax rate you use depends on the total amount of your taxable income, so work that out first. Any increase in these rates or an extension of.

Source: itep.org

Source: itep.org

Why Trump Administration’s Plan to Index Capital Gains to Inflation Is, Deloitte has called on the government to increase the €1 million lifetime limit against which company owners can apply for a reduced rate of capital gains tax. With the addition of the 3.8% net investment income tax (niit) designed to fund the affordable care act, and the additional medicare tax, the total capital gains rate could reach 44.6%.

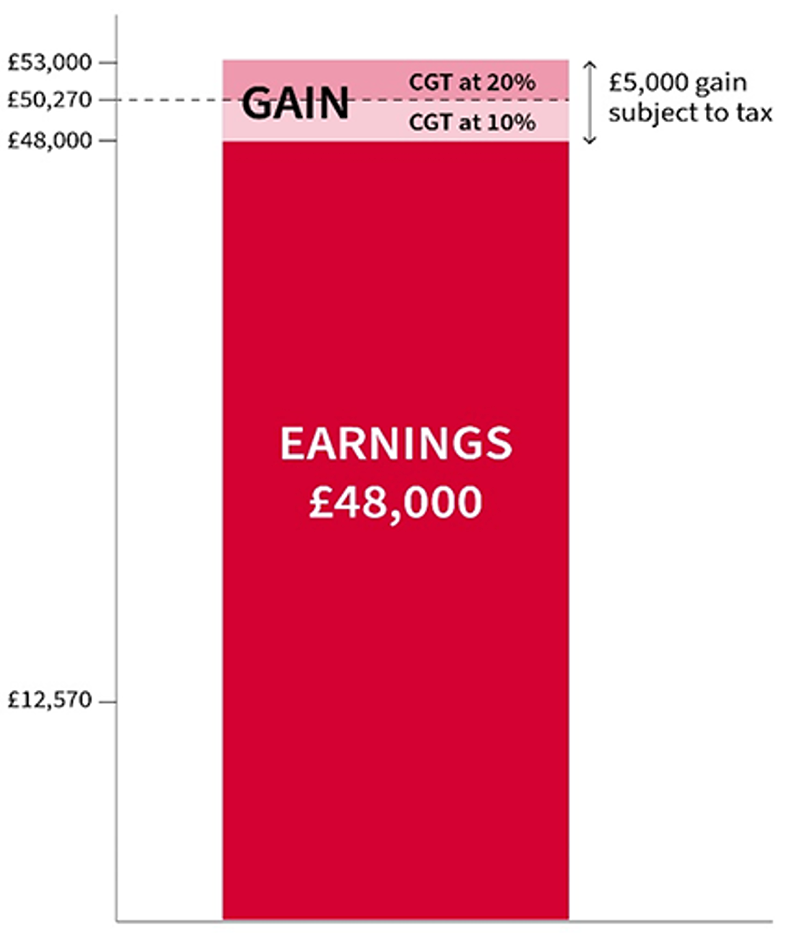

Source: www.ajbell.co.uk

Source: www.ajbell.co.uk

What is Capital Gains Tax? CGT Explained AJ Bell, Remember, this isn't for the tax return you file in 2025, but rather, any gains you incur. The news report, citing experts, indicated that rationalising and standardising the capital gains tax regime — by streamlining holding periods, ensuring uniformity in.

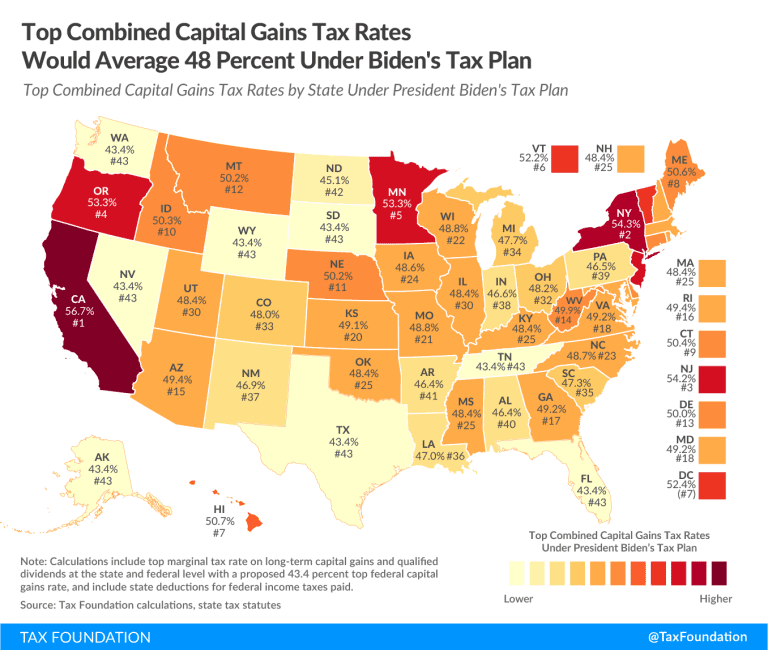

Source: taxfoundation.org

Source: taxfoundation.org

Biden Capital Gains Tax Plan Capital Gain Rates Under Biden Tax Plan, Gains made on disposals of residential property that do not qualify for prr are chargeable to cgt at 18% for any gains that fall within an. It adjusts the purchase price of assets to account for inflation, thereby.

Source: www.vjhaccountancy.co.uk

Source: www.vjhaccountancy.co.uk

Current Capital Gains Tax rates VJH Accountancy, Remember, this isn't for the tax return you file in 2025, but rather, any gains you incur. They have a net capital gain of $400,000 for the 2025 tax year.

Source: gillianwamitie.pages.dev

Source: gillianwamitie.pages.dev

Ca Long Term Capital Gains Tax Rate 2025 Tobi Aeriela, The individual income tax rates of 10%, 12%, 22%, 24%, 32%, 35% and 37% will return to 10%, 15%, 25%, 28%, 33%, 35% and 39.6%, with different. The corporate rate may affect your company’s bottom line, but congress will be more concerned about whether their decisions will lead companies to close us plants or lay.

Source: www.saltus.co.uk

Source: www.saltus.co.uk

Capital gains tax (CGT) a guide for UK investors Saltus, Deloitte has called on the government to increase the €1 million lifetime limit against which company owners can apply for a reduced rate of capital gains tax. A review and possible simplification of the capital.

They Have A Net Capital Gain Of $400,000 For The 2025 Tax Year.

How would the capital gains tax change under biden’s fy 2025 budget proposal?

The News Report, Citing Experts, Indicated That Rationalising And Standardising The Capital Gains Tax Regime — By Streamlining Holding Periods, Ensuring Uniformity In.

Confused about the federal income tax rates on capital gains and dividends under the tax cuts and jobs act (tcja)?

Category: 2025