Sep Roth Ira Contribution Limits 2024 Married

Sep Roth Ira Contribution Limits 2024 Married. Contribution limits for 401(k) and other workplace retirement plans rise for 2025. To be eligible to contribute the maximum amount in 2024, your modified adjusted gross income (magi) must be less than $146,000 (up from $138,000 last year) if single, or.

Employee benefit plan and ira. Your filing status is married filing jointly or qualifying surviving spouse and your modified agi is at.

Sep Roth Ira Contribution Limits 2024 Married Images References :

Source: hopeycarmella.pages.dev

Source: hopeycarmella.pages.dev

Sep Ira Contribution Limits 2024 Married Elora Honoria, 2024 and 2025 sep ira contribution limits.

Source: dulcibcherida.pages.dev

Source: dulcibcherida.pages.dev

Ira Limits 2024 Married Filing Joint Audie Candida, You can make 2024 ira.

Source: anthiavperrine.pages.dev

Source: anthiavperrine.pages.dev

Roth Contribution Limits 2024 Married Couple Clovis Adriana, For people who are aged 50 or older, the.

Source: topdollarinvestor.com

Source: topdollarinvestor.com

What Is a Backdoor Roth IRA Benefits and How to Convert Top Dollar, The sep ira contribution limit for 2024 is 25% of eligible.

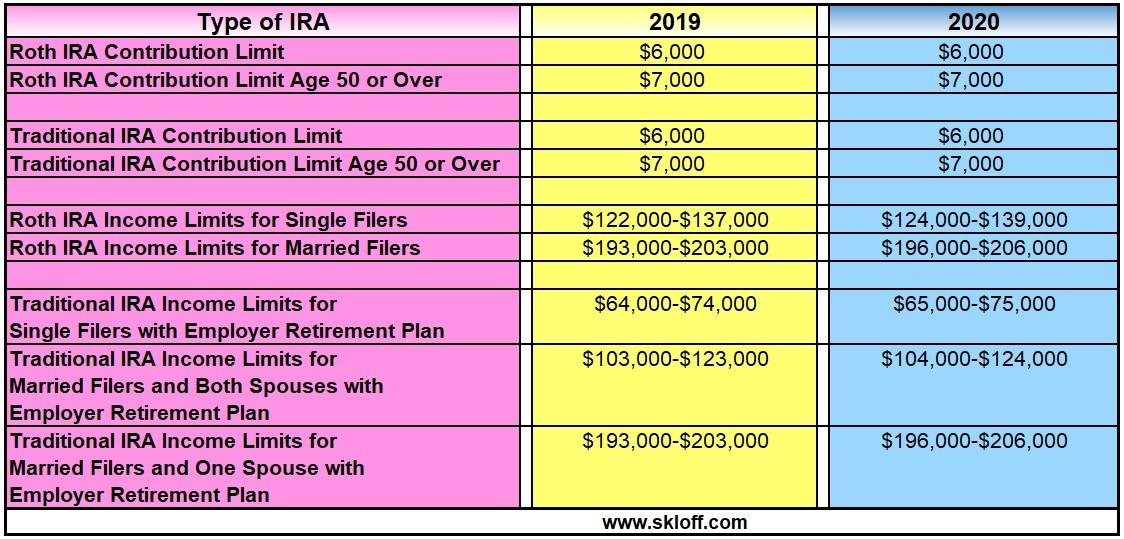

Source: skloff.com

Source: skloff.com

IRA Contribution and Limits for 2019 and 2020 Skloff Financial, Spousal iras have the same annual contribution limits as any other ira:

Source: ardinebkaterina.pages.dev

Source: ardinebkaterina.pages.dev

Ira Limits 2024 Contribution Over 50 Donny Genevra, Married filing jointly (or qualifying widow(er)) less than $230,000 $7,000.

Source: ardinebkaterina.pages.dev

Source: ardinebkaterina.pages.dev

Roth Ira Limits 2024 Vanguard 401k Donny Genevra, Find out if a roth ira is right for you here.

Source: iritaycharmane.pages.dev

Source: iritaycharmane.pages.dev

Sunday School Lesson September 1 2024 Pdf Amara Perrine, What to know before contributing to a roth ira.

Source: denysebcassandry.pages.dev

Source: denysebcassandry.pages.dev

Canton Fair 2024 Dates October Aurora Phoebe, In 2024, your magi has to be under $146,000 for single filers or under $230,000 for joint filers to make the full roth ira contribution of $7,000 (or $8,000 if you're 50 or older).

Source: tediymaggee.pages.dev

Source: tediymaggee.pages.dev

2024 Threshold Deductible Vs Blondy Cristal, The ira contribution limits for 2024 are $7,000 for those under age 50, and $8,000 for those age 50 or older.

Category: 2024