What Is The Marital Deduction For 2024

What Is The Marital Deduction For 2024. Do you have an estate plan? Here are the six income tax rules that will apply from april 1, 2024:

The unlimited marital deduction is a provision in the u.s. Do you have an estate plan?

Maximizing Gifting To Lower Estate Value.

Updated on january 12, 2023.

Fact Checked By Hilarey Gould.

Momo productions / getty images.

The New Financial Years Starts From April 1.

Images References :

Source: www.financestrategists.com

Source: www.financestrategists.com

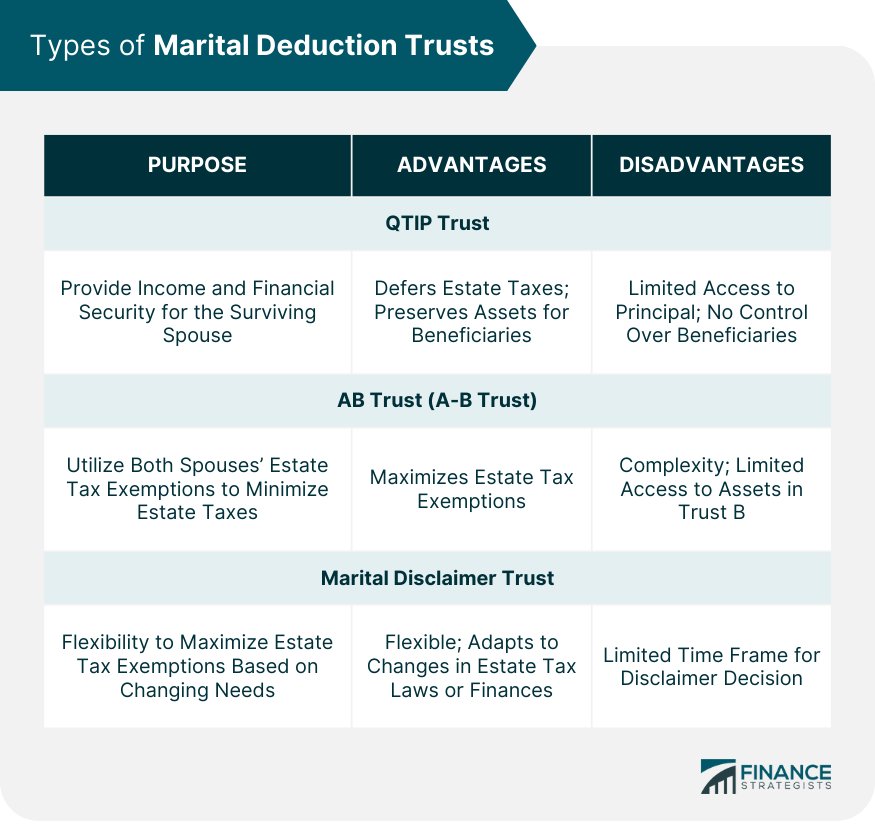

Marital Deduction Trusts Definition, Requirements, & Types, With the new financial year starting, salaried individuals must decide between old and new tax regimes. For single taxpayers, the 2024 standard deduction is $14,600, up $750 from 2023;

Source: www.wiztax.com

Source: www.wiztax.com

2023 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, The unlimited marital deduction is a provision in the us estate tax law that allows a married individual to transfer an unlimited amount of assets to their spouse, both during life and at death, without incurring. Do you have an estate plan?

Source: www.baronlawcleveland.com

Source: www.baronlawcleveland.com

The Marital Deduction What are the benefits? Baron Law, LLC, Federal estate and gift tax law that allows an individual to transfer an unrestricted amount of assets to. A marital deduction will be allowed if the insured or the surviving spouse selects a settlement option with the insurer giving the surviving spouse income from the.

Source: www.attorneyoffice.com

Source: www.attorneyoffice.com

Free Report What is the Estate Tax Marital Deduction? Litherland, The marital deduction is determinable from the overall gross estate. Maximizing gifting to lower estate value.

Source: finance.gov.capital

Source: finance.gov.capital

What is the Marital Deduction? Finance.Gov.Capital, Maximizing gifting to lower estate value. It’s the simplest way to reduce your.

Source: www.myestateplan.com

Source: www.myestateplan.com

What Is The Federal Estate Tax Marital Deduction, The unlimited marital deduction is a provision in the u.s. It allows one marriage partner to transfer an unlimited amount of assets to their spouse without incurring a tax.

Source: support.leimberg.com

Source: support.leimberg.com

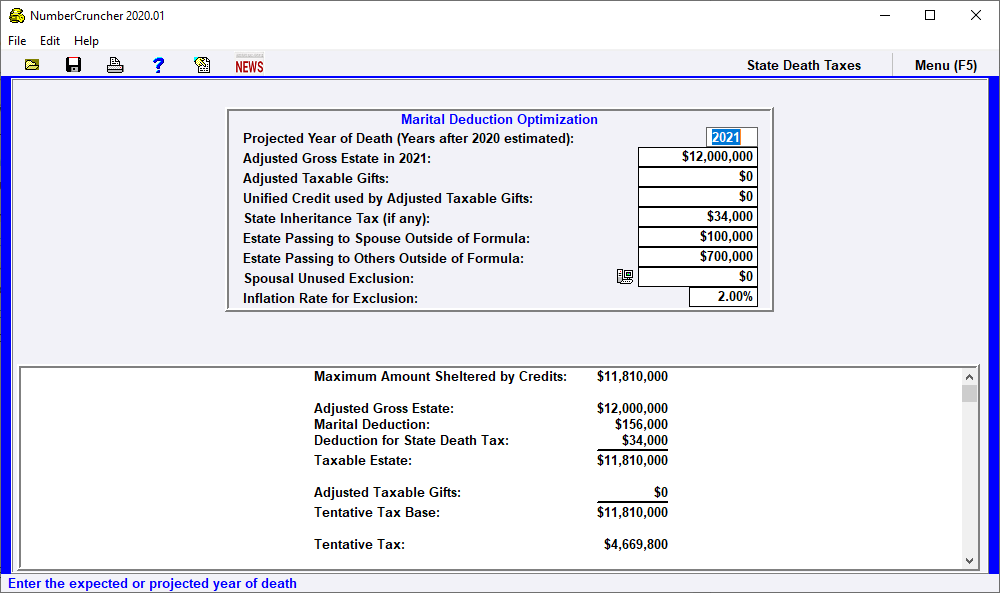

Mar. Ded. Marital Deduction Optimization Leimberg, LeClair, For single taxpayers, the 2024 standard deduction is $14,600, up $750 from 2023; Family pensioners can also benefit from this deduction.

Standard deduction Married filing jointly and surviving spouses Single, The marital deduction is determinable from the overall gross estate. Fact checked by hilarey gould.

Marital Deduction Definition What Does Marital Deduction Mean?, The unlimited marital deduction is a provision in the u.s. For example, if an individual were to.

Source: www.lorman.com

Source: www.lorman.com

Marital Deduction Formula Planning Pecuniary vs. Fractional, The #1 tool in estate tax planning » paul sundin, cpa. However, a citizen spouse may gift up to $185,000 (in 2024) per year to a noncitizen spouse.

Fact Checked By Hilarey Gould.

For people who pass away in 2024, the exemption amount is $13.61 million (up from the $12.92 million 2023 estate tax exemption amount).

The Default Option Is Now The.

The marital deduction is an unlimited estate and gift tax deduction for transfers made during life or at death to a spouse.